This topic explains how to reconcile the purchase order against the tax invoice for a completed paperless goods receipt batch, after the goods receipt has been processed on a PDA.

Refer to "Goods Received - File - Load Completed Paperless".

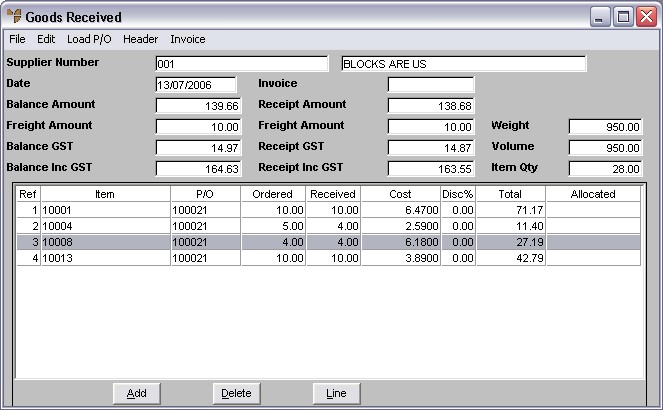

Micronet displays the Goods Received screen showing all the lines in the goods receipt batch.

The following examples illustrate this process using the information shown on the screen above.

Refer to "Goods Received - File - Post Costed".

In the screen above, item 10001 matches the tax invoice with the quantity Ordered 10, quantity Received 10 and Cost $6.47.

There are no issues to be resolved with this item.

In the screen above, a quantity of 5 was Ordered for item 10004 but only 4 were Received. However, as we were only charged for 4 on the tax invoice, there are no issues to be resolved with this item.

If we allowed backorders for this supplier, then the quantity undersupplied may turn up later.

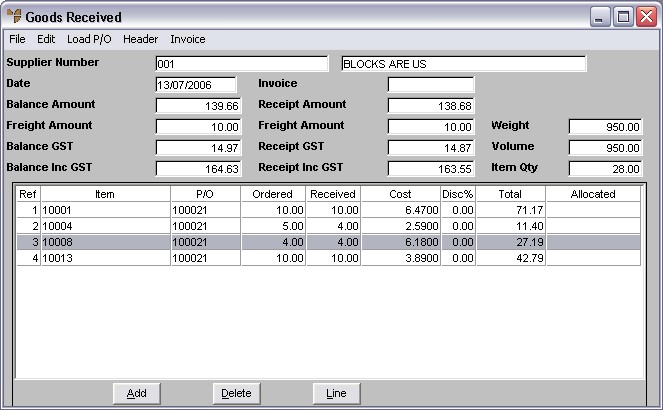

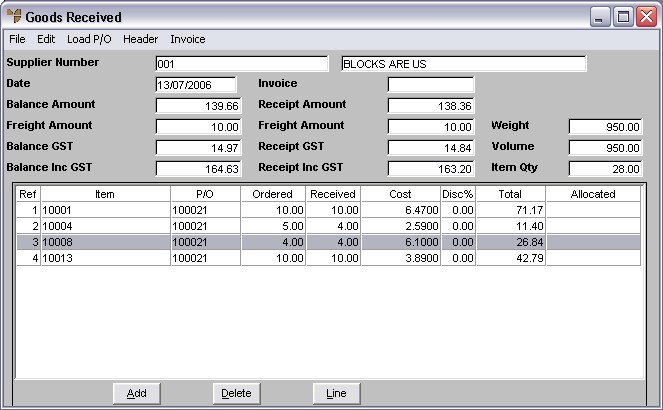

In the screen above, item 10008 matches the tax invoice with the quantity Ordered 4 and the quantity Received also 4. However, a price variance is found as the tax invoice price of $6.10 is cheaper then the purchase order price of $6.18.

In this case, we can just change the purchase order price to match the invoice.

Micronet displays the Enter Goods Received Line screen (refer to "Entering Goods Received Lines").

You will now see that the Receipt Inc GST amount changes, and should get closer to the Balance Inc GST amount.

In the screen above, item 10013 matches the tax invoice with the quantity Ordered 10 and the quantity Received also 10. However, a price variance is found as the tax invoice price of $4.02 is more expensive then the purchase order price of $3.89.

You need to confirm whether this price is acceptable with purchasing.

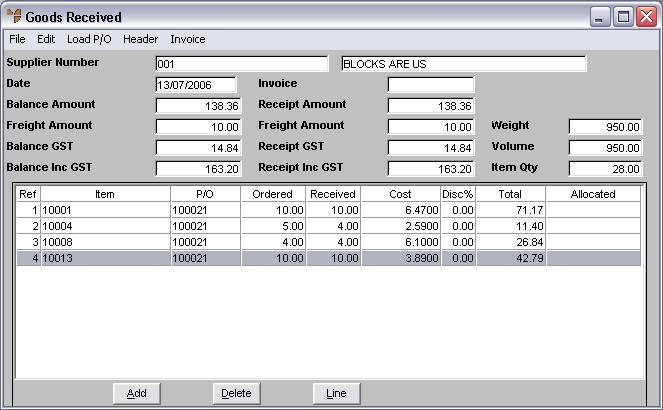

If the price increase is acceptable, you can change the purchase order price to match the invoice.

Micronet displays the Enter Goods Received Line screen (refer to "Entering Goods Received Lines").

If the price increase is not acceptable, you need to adjust the Balance Inc GST down by the difference.

Micronet displays the Goods Received Header screen (refer to "Maintaining the Goods Received Header").

Micronet redisplays the Goods Received screen.

You will now see that the Receipt Inc GST amount equals the Balance Inc GST amount.

|

|

|

Technical Tip

|